>> Now Accepting Scholarship Entries for FALL 2023! <<

Ai Engstrom National Scholarship

PCB Solutions, a provider of high-quality printed circuit board manufacturing, is pleased to announce we will be holding an “Chuan Ai Lu Engstrom Memorial Scholarship Contest”. The winner selected will receive a $1000 scholarship to the college of their attendance.

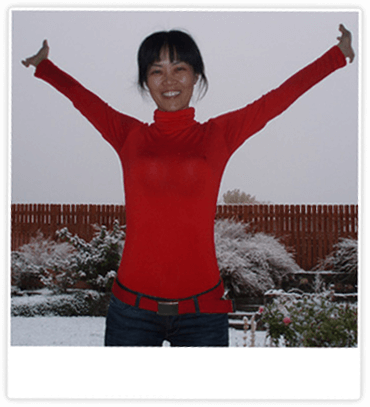

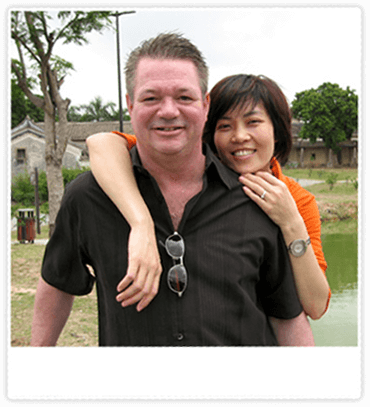

The scholarship was created in tribute to former employee Chuan Ai Lu Engstrom who passed away in 2014 from uterine cancer. Ai emigrated from China after marrying PCB Solutions’ president Greg Engstrom and became an American citizen.

Ai loved learning English and was proud to be an American. This scholarship is in honor of her loving, kind and patient legacy. She was an optimistic, loving human being. Even in the worst of times and through her pain and suffering, she was always optimistic. She smiled her way through life and will be greatly missed. She is survived and always loved by family, friends and her husband, Greg Engstrom.

WHO IS ELIGIBLE?

Any current, full-time student of an accredited American university

or college, with a minimum cumulative GPA of at least 2.5, is welcome to apply.

There is no age requirement.

HOW TO APPLY:

(1) Write an essay of no fewer than 800 words about the topic: Discuss your vision of electronic design, engineering and manufacturing in the global economy.

Candidates can use any of the following to help with writing the essay:

- a. If applicable, describe any experience in manufacturing, logistics, electrical or mechanical engineering, or business that would support your vision. The strongest essay submissions are sourced and referenced to reputable publications.

- b. Provide entrepreneurial ideas about international business, starting and running your own business, and how your management style would be instrumental in your success.

- c. The topic is broad and can include: healthcare, business, science, engineering, etc.

- d. Do not make the essay about your history. You may do this through a short video or a short written summary noted below.

(2) Include a short bio video or short written essay describing yourself, your history, why education is important to you and how you will use your scholarship money.

(3) Email your essay via word doc or pdf to: jamesb@pcb-solutions.com

(4) Email a Content Contribution Agreement (Download Here), along with your full contact information, major, graduation date and essay to: jamesb@pcb-solutions.com

(5) Awarded Scholarships can be found on the “Scholarship Award Winners” page.

DEADLINE FOR SUBMISSION:

The essay submission deadline is August 1st for fall semester and December 1st for the spring semester. The scholarship program will be ongoing with two different winners awarded each calendar year.

SELECTION PROCESS AND NOTIFICATION:

Essays will be reviewed by the PCB Solutions Scholarship Committee and the winner will be announced on August 15th for fall and December 15th for spring on the PCB website. The winner will also be notified via email.

ADDITIONAL DETAILS:

The scholarship funds awarded can be used for school related expenses of the student’s choice. Once awarded, a check will be written to the recipient’s enrolled school and credited for academic costs. Scholarship is non-renewable and is only good for one semester cycle. Recipients are only eligible to receive the scholarship once during their lifetime.

QUESTIONS?

Any questions on the scholarship essay contest can be directed to: jamesb@pcb-solutions.com